All Categories

Featured

Table of Contents

When life stops, the bereaved have no selection yet to keep moving. Practically promptly, family members have to manage the overwhelming logistics of fatality adhering to the loss of a loved one.

On top of that, a full survivor benefit is typically attended to unintentional fatality. A customized survivor benefit returns premium often at 10% passion if fatality happens in the very first two years and entails one of the most loosened up underwriting. The full fatality advantage is usually offered unintentional fatality. A lot of sales are carried out face-to-face, and the sector trend is to approve an electronic or voice signature, with point-of-sale choices gathered and taped via a laptop computer or tablet.

To underwrite this company, business rely on personal wellness interviews or third-party information such as prescription backgrounds, scams checks, or motor vehicle records. Financing tele-interviews and prescription histories can frequently be made use of to assist the agent finish the application process. Historically business depend on telephone interviews to confirm or verify disclosure, yet much more lately to improve client experience, firms are depending on the third-party information indicated above and providing immediate decisions at the factor of sale without the meeting.

Funeral Cover Online Quote

What is final cost insurance coverage, and is it constantly the finest course forward? Below, we take an appearance at just how final expense insurance functions and factors to take into consideration prior to you get it.

While it is described as a policy to cover last costs, recipients that receive the fatality advantage are not called for to use it to pay for last expenditures they can utilize it for any type of objective they such as. That's due to the fact that last cost insurance coverage really comes under the classification of customized whole life insurance or simplified issue life insurance, which are commonly entire life policies with smaller sized death advantages, typically in between $2,000 and $20,000.

Our point of views are our own. Interment insurance coverage is a life insurance coverage plan that covers end-of-life costs.

Funeral Advantage Program Assistance Seniors

Interment insurance coverage needs no clinical test, making it obtainable to those with medical conditions. The loss of an enjoyed one is psychological and traumatic. Making funeral preparations and finding a means to spend for them while grieving adds one more layer of stress. This is where having burial insurance policy, likewise known as last expenditure insurance policy, is available in handy.

Simplified concern life insurance coverage calls for a health and wellness analysis. If your health status invalidates you from standard life insurance policy, funeral insurance might be an option.

Compare budget friendly life insurance choices with Policygenius. Term and irreversible life insurance coverage, interment insurance policy can be found in numerous kinds. Have a look at your insurance coverage options for funeral costs. Guaranteed-issue life insurance has no wellness needs and offers quick approval for insurance coverage, which can be useful if you have severe, terminal, or numerous health conditions.

Final Expense Life Insurance Company

Simplified concern life insurance policy does not call for a medical exam, however it does call for a health set of questions. This policy is best for those with light to modest health and wellness problems, like high blood pressure, diabetic issues, or asthma. If you do not desire a medical examination yet can get approved for a simplified issue policy, it is generally a far better bargain than an ensured problem policy since you can get more protection for a less costly premium.

Pre-need insurance policy is risky due to the fact that the beneficiary is the funeral home and coverage is certain to the picked funeral chapel. Should the funeral chapel fail or you move out of state, you may not have insurance coverage, and that defeats the objective of pre-planning. Additionally, according to the AARP, the Funeral Consumers Partnership (FCA) discourages acquiring pre-need.

Those are essentially funeral insurance policy policies. For assured life insurance policy, costs computations rely on your age, gender, where you live, and coverage amount. Understand that coverage quantities are restricted and vary by insurance policy supplier. We discovered sample quotes for a 51-year-woman for $25,000 in protection living in Illinois: You might decide to pull out of burial insurance policy if you can or have actually saved up adequate funds to settle your funeral service and any type of arrearage.

Burial insurance offers a streamlined application for end-of-life insurance coverage. The majority of insurance companies require you to speak to an insurance policy representative to use for a policy and obtain a quote.

The goal of having life insurance policy is to reduce the burden on your loved ones after your loss. If you have a supplementary funeral service plan, your enjoyed ones can utilize the funeral plan to manage final expenses and get a prompt dispensation from your life insurance policy to handle the mortgage and education costs.

Individuals who are middle-aged or older with clinical problems might consider funeral insurance coverage, as they might not certify for standard plans with stricter approval requirements. Additionally, interment insurance coverage can be useful to those without considerable financial savings or conventional life insurance policy coverage. Funeral insurance coverage differs from various other kinds of insurance policy because it supplies a lower death benefit, normally just sufficient to cover costs for a funeral service and various other associated expenses.

Senior Final Expense Benefits

News & World Report. ExperienceAlani has reviewed life insurance coverage and pet dog insurance provider and has written numerous explainers on travel insurance policy, credit scores, debt, and home insurance. She is passionate concerning demystifying the complexities of insurance policy and other individual financing subjects to ensure that readers have the info they require to make the most effective money choices.

Last cost life insurance has a number of benefits. Last expenditure insurance coverage is frequently advised for elders that may not qualify for conventional life insurance policy due to their age.

In enhancement, final expenditure insurance is valuable for individuals who desire to spend for their own funeral service. Funeral and cremation solutions can be costly, so last cost insurance coverage offers satisfaction understanding that your loved ones won't need to utilize their savings to spend for your end-of-life plans. However, last cost insurance coverage is not the best product for every person.

Burial Policies For Seniors

Obtaining whole life insurance through Ethos is quick and easy. Insurance coverage is offered for seniors in between the ages of 66-85, and there's no clinical test called for.

Based on your reactions, you'll see your approximated rate and the amount of protection you get (between $1,000-$30,000). You can purchase a plan online, and your coverage begins promptly after paying the very first costs. Your price never ever changes, and you are covered for your whole life time, if you continue making the monthly settlements.

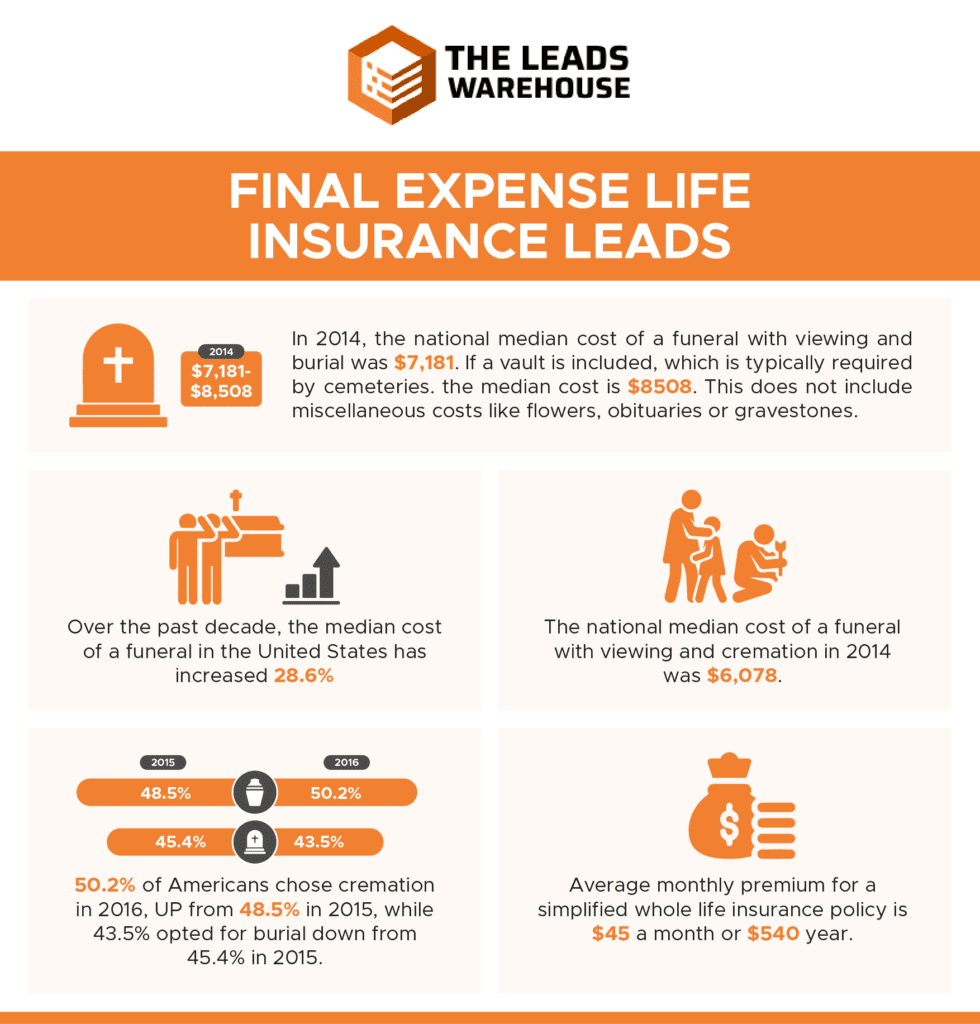

At some point, most of us need to believe about exactly how we'll pay for an enjoyed one's, and even our own, end-of-life costs. When you offer last cost insurance coverage, you can supply your clients with the peace of mind that comes with recognizing they and their families are gotten ready for the future. You can likewise acquire an opportunity to optimize your book of company and produce a new earnings stream! Prepared to learn whatever you require to recognize to begin offering final cost insurance policy efficiently? No one likes to consider their own fatality, but the reality of the issue is funerals and funerals aren't inexpensive.

On top of that, customers for this kind of strategy might have serious lawful or criminal backgrounds. It is essential to keep in mind that various providers provide a series of concern ages on their guaranteed problem policies as reduced as age 40 or as high as age 80. Some will certainly additionally use higher stated value, as much as $40,000, and others will certainly allow for better fatality benefit problems by improving the rates of interest with the return of costs or lessening the number of years up until a complete fatality benefit is offered.

Latest Posts

Term To 100 Life Insurance

What Does Level Term Mean In Life Insurance

Get Burial Insurance